An accounting audit is one in which an independent auditor registered in the ROAC (Official Register of Account Auditors) issues an opinion on whether the Annual Accounts of a company reflect a true and fair view of the company, i.e. its real economic, financial and equity situation.

In addition, the ROAC auditor's analysis can help us:

- Discover the SWOT of our company, i.e., weaknesses, threats, strengths and opportunities.

- Improve the financial and administrative control of our company.

- To use accounting as a tool for an efficient management of our company, the latter being very useful in decision making.

- To show an image of transparency to our stakeholders such as customers, suppliers, financial institutions, public administration, society, partners, employees, etc.

| ACTIVE | NET SALES (REVENUES) | EMPLOYEES |

| 2.8 million | 5.7 million | 50 employees |

Although it is true that, in the first fiscal year after its incorporation, transformation or merger, companies are exempt from the obligation to be audited if they meet, at the close of said fiscal year, at least two of the three circumstances expressed in the previous section. Calculate if you need to be audited.

Yes, it should be borne in mind that even if they do not meet the above parameters, companies are obliged to be audited, according to the first additional provision of the Audit Law:

a) That issue securities admitted to trading on official secondary securities markets or multilateral trading systems.

b) That issue debentures in public offering.

c) That are habitually engaged in financial intermediation and, in any case, credit institutions, investment services companies, official secondary market management companies, multilateral trading systems management companies, the Sociedad de Sistemas, central counterparty entities, the Sociedad de Bolsas, investment guarantee fund management companies and other financial institutions, including collective investment institutions, securitization funds and their managers, registered in the corresponding registers of the Bank of Spain, the Sociedad de Bolsas, the management companies of investment guarantee funds and other financial entities, including collective investment institutions, securitization funds and their managers, registered in the corresponding Registries of the Bank of Spain and the National Securities Market Commission.

d) Whose corporate purpose is any activity subject to the Revised Text of the Law of Regulation and Supervision of Private Insurance, approved by Royal Legislative Decree 6/2004, of October 29, 2004, within the limits established by regulations, as well as pension funds and their managing entities.

e) That during a fiscal year they have received subsidies or aid charged to the budgets of the Public Administrations or to funds of the European Union for a total accumulated amount exceeding 600,000 euros.

f) That during a fiscal year they have entered into contracts with the Public Sector for a total accumulated amount exceeding 600,000 euros, and this represents more than 50% of their annual net turnover.

g) It must be a housing cooperative and meet one of the following conditions:

-

- That has more than 50 premises and/or dwellings under development.

- When the development corresponds to different phases, or when they are built in different blocks that constitute different developments, regardless of the number of dwellings and premises under development.

- That the cooperative has granted powers of attorney relating to business management to natural or legal persons other than the members of the Governing Council.

h) That they are foundations in which, as of the closing date of the fiscal year, at least two of the following circumstances are present:

-

- That the total of the asset items exceeds 2,400,000 euros.

- That the net amount of its annual income from its own activity plus, if applicable, the turnover of its commercial activity exceeds 2,400,000 euros.

- The average number of employees employed during the fiscal year is greater than 50.

i) That include in their bylaws the obligation to audit.

j) As agreed by the members in general meeting.

k) That the shareholders representing 5% or more of the capital stock request it to the commercial registrar of the registered office (provided that three months have not elapsed from the closing date of said fiscal year).

Just as two of the three parameters in the previous question must be met in order to have the obligation to be audited in two consecutive fiscal years, this obligation will also be lost if two of the three previous parameters are not met for two consecutive fiscal years.

Of course, there is also the voluntary audit modality, which is also regulated by the Account Auditing Law.

In addition, as we have mentioned in previous questions, an audit can give you a global vision of the state of your company, especially in those cases in which you plan to carry out important operations such as the purchase or sale of shares, mergers, etc.

Following the latest reform of the ISA-ES the opinion can be seen in the first paragraph of the report. There are the following opinions that can be given in an audit report by a ROAC auditor under the International Standards on Auditing in Spain (ISA-ES) in force:

- Favorable or unqualified opinion: This opinion in an audit report tells us that the company gives a true and fair view of its economic, financial and equity situation in all respects without any exceptions.

- Qualified opinion: This opinion in an auditor's report means that the company gives a true and fair view of its economic, financial and equity situation in all respects, except for certain significant, but not generalized, nuances detailed in the following paragraph.

These nuances can be of various types:

i. By limitation to the scope: not having been able to obtain sufficient and appropriate evidence on any relevant aspect of the annual accounts.

ii. Due to the existence of errors: Unlike the previous point, in this case it has been possible to verify the area and even quantify the errors.

iii. For non-compliance with regulations: this type of opinion is produced when there is non-compliance with any applicable regulation affecting the preparation of the Annual Accounts, such as, for example, the General Accounting Plan, the Capital Companies Act, etc.

iv. For omission of information: This type of opinion occurs when relevant information that should be included in the report is omitted.

- Unfavorable opinion: This type of opinion is produced when multiple errors or generalized and very significant non-compliances are detected that result in the company not reflecting a true and fair view of its economic, financial and equity situation.

- Opinion denied: This type of opinion is produced when the ROAC auditor has not had the possibility of issuing a clear opinion because there are multiple generalized uncertainties that prevent it from doing so.

Yes, as long as the Annual Accounts have not been approved and deposited in the pertinent registry (such as mercantile, cooperatives, S.A.T., etc.) as a general rule.

The auditor must be appointed by the General Meeting of the company, except in the case of a company that is obliged to appoint the auditor because it is subject to public control. In the latter case, it will be the Administration that appoints the auditor.

In companies that are not obliged to have their accounts audited because they do not meet the requirements, shareholders representing at least five percent of the capital stock may request the commercial registrar to appoint an auditor to audit the annual accounts for a given year, provided that three months have not elapsed since the closing date of that year.

Both the Capital Companies Act (art. 264) and the Andalusian Cooperatives Act (art. 73) and its implementing regulations (art. 58) establish that the auditor must be appointed before the end of the year to be audited, i.e., if the year to be audited is 2020, we will have from January 1 to December 31 of that year to make such appointment by the General Meeting, General Assembly or other appropriate governing body depending on the corporate nature of the company.

Both the Capital Companies Act (art. 264) and the Andalusian Cooperatives Act (art. 73) and its implementing regulations (art. 58) establish that the auditor must be appointed before the end of the year to be audited, i.e., if the year to be audited is 2020, we will have from January 1 to December 31 of that year to make such appointment by the General Meeting, General Assembly or other appropriate governing body depending on the corporate nature of the company.

Article 22 of the current account auditing law establishes that the first contract may not be made for periods of less than 3 years or more than 9 years, and that renewals must be made for successive periods of 3 years.

During the term of the contracts, the same may not be terminated without just cause, differences of opinion between the parties not being just cause. In any case, should such termination occur, it must be communicated to the Instituto de Contabilidad y Auditoría de Cuentas by both parties pursuant to Article 40 of the Ley de Auditoría de Cuentas.

In addition, the fourth point of said article also states that "Shareholders holding more than five percent of the capital stock or voting rights of the audited entity or the administrative body of said entity may request the judge of first instance of the registered office of the entity to revoke the auditor appointed by the general meeting and appoint another auditor, when there is just cause. Likewise, such request may be made by the Instituto de Contabilidad y Auditoría de Cuentas".

Pursuant to Article 8 of the Account Auditing Law, individuals or legal entities authorized to audit accounts are those registered in the Official Registry of Account Auditing (ROAC) of the Institute of Accounting and Account Auditing (Instituto de Contabilidad y Auditoría de Cuentas).

Apart from those cases of mandatory audit (if the parameters of the previous questions are met) or voluntary audit, sometimes a ROAC auditor is required for:

- Reports on procedures such as: supporting accounts for subsidies, Ecoembes, waste management subsidies, etc.

- Issuance of convertible debentures

- Special regime for the exclusion of preemptive subscription rights

- Capital stock increase by offsetting credits or charged to reserves

- Reduction of capital stock due to losses

- Among others

- If your company is obliged to audit its annual accounts and you do not comply with this duty, you will not be able to file your company's annual accounts with the Commercial Registry and the corresponding filing of accounts cannot be made until this defect has been remedied. This, in turn, may result in the Mercantile Registrar not registering any document presented subsequently, with some exceptions, after one year has elapsed since the end of the financial year.

- This means that the company could not make any changes, such as capital increases, sell shares or any other act that must be published in the registry until it has deposited the corresponding audit report with the Mercantile Registry.

Those companies that are obliged to be audited but do not file the annual accounts with the pertinent audit report will be subject to a closure of the commercial registry, which means that nothing more can be registered in said registry, such as operations carried out by means of a corporate deed.

In addition, the regulations of the commercial registry establish penalties for such non-compliance.

This period depends on many factors, but Article 270 of the Capital Companies Act establishes that the auditor shall have at least one month to issue the audit report from the date of delivery of the financial statements by the directors.

Although it is true that this period is influenced to a greater extent by the fluidity of communication with the audited entity, since the auditor must issue the audit report once sufficient and adequate evidence of the economic, financial and equity situation of the company to be audited has been obtained.

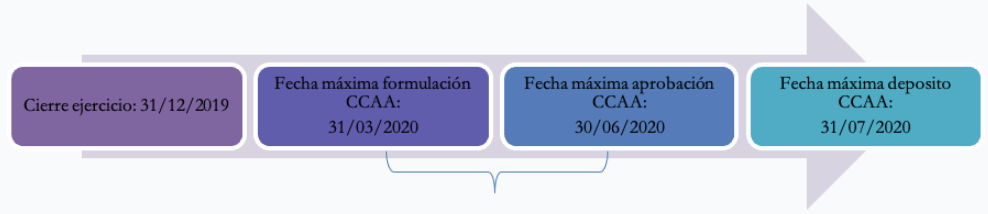

Below, we illustrate the deadlines using the example of a company whose closing date is December 31, 2019.

Period to perform the accounting audit

| ACTIVE | NET SALES (REVENUES) | EMPLOYEES |

| 4 million | 8 million | 50 employees |

In addition, this article also allows the preparation of abridged annual accounts in the first fiscal year after the incorporation, transformation or merger of the company. On the other hand, Article 258 of the same law allows the preparation of abridged profit and loss accounts (the rest of the financial statements being normal) if two of the following parameters are not exceeded during two consecutive years:

| ACTIVE | NET SALES (REVENUES) | EMPLOYEES |

| 11.4 million | 22.8 million | 250 employees |

Article 42 of the Commercial Code regulates this real obligation in Article 1:

“1. Every parent company of a group of companies is obliged to prepare consolidated financial statements and a consolidated management report. in the manner provided in this section.

A group exists when a The Company holds or may hold, directly or indirectly, the control of one or more other companies. In particular, the control shall be presumed to exist when a company, which shall be classified as the controlling company, is in relation to another company, which shall be classified as a subsidiary, in any of the following situations:

a) Has the majority of voting rights.

b) Have the power to appoint or dismiss the majority of the members of the administrative body.

(c) May dispose, by virtue of agreements with third parties, of the majority of the voting rights.

d) Has appointed with its votes a majority of the members of the administrative body, the Company's directors, who are in office at the time the consolidated financial statements are to be prepared and during the two immediately preceding fiscal years, shall be deemed to be members of the board of directors of the controlled company. In particular, this circumstance will be presumed when the majority of the members of the governing body of the controlled company are members of the governing body or senior executives of the controlling company or of another company controlled by the latter. This assumption shall not give rise to consolidation if the company whose directors have been appointed is related to another company in any of the cases provided for in the first two letters of this paragraph."

While it is true that not all companies that meet the above circumstances will be required to consolidate there are exceptions regulated in Article 43 of the Commercial Code. Some of the most notable exceptions are:

- Companies that at the closing date of the fiscal year of the company obligated to consolidate the companies as a whole did not exceed, in their last annual accounts, two of the limits for the formulation of an abridged profit and loss statement, unless one of the group companies is considered a public interest entity.

When the company required to consolidate participates exclusively in subsidiaries that do not have a significant interest, individually and as a whole, in the true and fair view of the net worth, financial position and results of the companies in the group.